MINE TO MARKET - September/October 2014

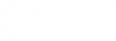

As traders and hedge funds came back from summer holidays at the beginning of September, they wasted no time in expressing their intention to sell all the precious metals and test every significant support level they could find.

Gold tried to find support all the way down and the Chinese buyers did their best to hold it up during their session but the selling pressure was too great (particularly in the New York time zone).

Once gold was trading in the low USD1200’s, the test of the old support level at USD1180 was almost inevitable. As the yellow metal has done on two previous occasions, however, the overall buying and bargain-hunting arrived in large enough numbers to turn the sellers around. With some sketchier economic numbers coming out of the US and the accompanying dollar weakness along with some push-back on the timing of possible interest rate hikes, some shorts were forced to cover and pushed the metal up USD50/oz in relatively short shrift.

Whether the triple bottom at USD1180 created from the lows seen in June and December last year and the recent test this month are enough to put gold back into a bullish frame of mind, is yet to play out. The end of December and early January will probably be the crucial time to see how this scenario plays out.

The USD1243.00 is probably the next critical level for gold to break through on the upside to confirm the continuation of the recent bullish sentiment.

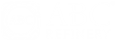

Silver was hit hard as well early in the month and struggled to recover all through September and into October. The gold-silver ratio blew out to over 1:71 which is the highest level since April 2009. It made some attempts to outpace gold during the rallies but seemed to be well met in any drive upwards. Interestingly, physical silver for prompt delivery appears to be in relatively short supply and some of the “friends of silver” are definitely trying to add to their long positions at these lower levels.

It appears now to be a battle between the paper-trading shorts versus the physical buyers and the result of the tussle in gold will probably dictate who wins this stoush in silver as well.

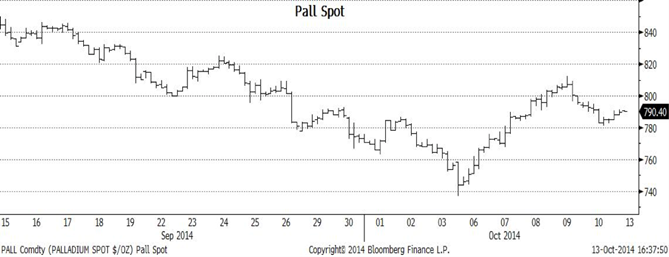

Palladium dropped through all of its recognised short-term supports including the critical USD830 level to leave the long position holders struggling to determine the next reasonable place to buy. Having said that, these position holders did not capitulate but rather continued to add to their holdings (increasing the net long speculative position in NYMEX futures by 61,000 oz). It found its footing at the same time as the gold but the USD810 seems to have replaced the USD910 level as the of resistance for any rally.

Still anaemic (but slightly improving statistics out of China raise the question about the increased demand for cars and by inference the demand for palladium. It does seem, however, that palladium supply is still somewhat disrupted with the continued conflict between Russia and the Ukraine and the inherent question mark over the supply with the sanctions that are being rolled out.

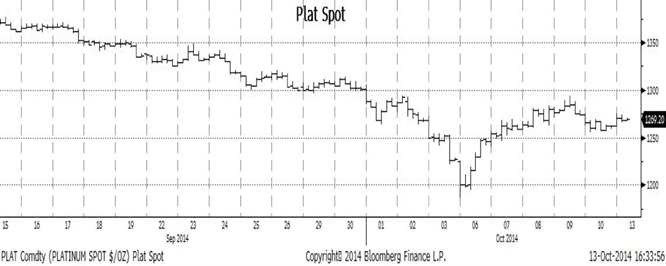

Platinum was not left out of the wholesale trashing of the precious metals market but again the current holders of long positions (apart from the TOCOM) did not blink and seemed to be looking to add to their positions at the lower levels. Consumers took the opportunity to hedge some of their buying requirements for the next little while and provided support as well.

Notably the Gold/Platinum ratio came back to a level of very nearly 1:1 a scenario not seen since the end of December last year.

Written by Mike Ward. First appeared in Jewellery World Magazine September Edition 2014.