MINE TO MARKET - September 2015 Precious Metals Prices Commentary

Gold

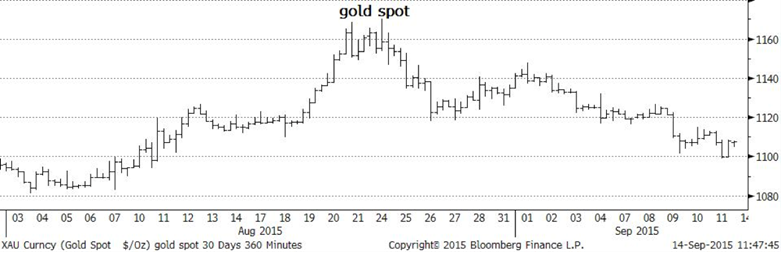

The US gold managed to not only fill the gap left by the big drop in July but also staged enough of a rally to induce some punters to go long as well. After breaching US1160 on the upside, rhetoric centred around the next target of US1200. Unfortunately (as is so often the case in these non-trending markets) it ran out of wind and came back to the US1120 support level.

From there it attempted another weak rally but the impetus was largely dissipated already and it sagged back to the USD1100 level by early September. The likelihood from here is that we will see a retest of the US1080 level and this will become the pivot for the next move in either direction.

Again, the elephant in the room is the US interest rates, which have still not been touched. The trigger point, however, is now getting closer (surely?). December seems to be the most popular current guess on the timing of the first rate hike but the impact on the USD gold market is now somewhat questionable depending on whether you believe it is built into the gold price already or not.

The open speculative positions reflect this uncertainty as well with a significant reduction in long positions in the futures markets over the last couple of weeks and the net ETF positions reduced as well. There were also however some patches of sporadic buying from some of the funds, illustrating the mixed feeling in the speculative market at this point.

From the fundamentals side, Chinese and Indian physical demand is present but not strong at these levels and there is definitely the wish (or hope) for a lower price from their perspective to create a decent buying opportunity again.

The Chinese stock market seems to have settled down somewhat and so the flight to quality that helped gold is now abating as well.

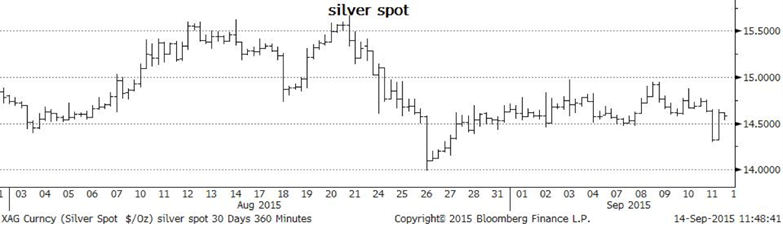

Silver showed some signs of positivity this month too but as always, when the going got tough, it suffered the most. The gold/silver ratio ran up through 80:1 at one point during the month which is a level not seen since the middle of the GFC.

It did have its moments though, and although some of the air has come out of the ETF’s it is still an amazingly sticky bunch of cohorts who continue to hold onto this metal through thick and thin.

The physical demand seems to be far outstripping the supply at current prices and although these phenomena usually don’t last very long, the fact that the Mints around the world are struggling to keep up with demand for silver coins and other silver bullion pieces, implies that there is very good underlying support for silver investment pieces as the price drifts lower. The biggest issue for it is to try to find a true historical support level that should hold and realistically this could be as low as USD12.00 per ounce.

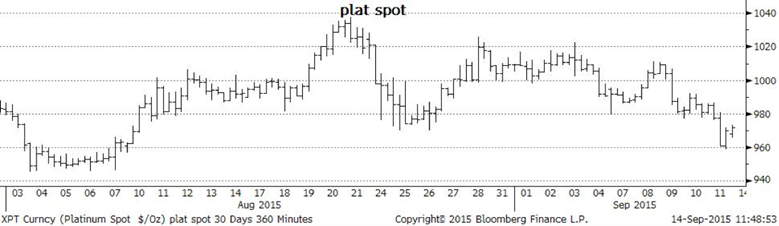

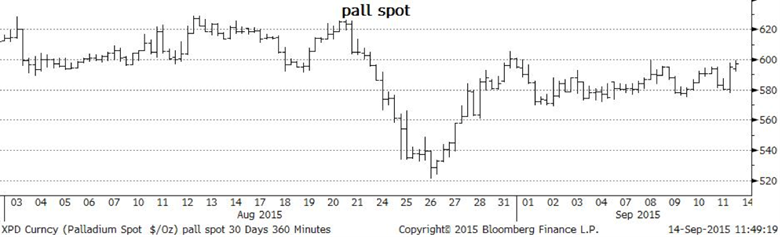

Platinum and palladium have both seemed to find their feet somewhat with minor rallies instilling hope in some that the bottom of these markets may be nigh.

Platinum climbed above USD1,000 an ounce again (mainly on short-covering it appears) but has run out of steam as the world stock markets settle down and positive data out of the US has a negative impact on the price. Some of the speculative interest has also leaked out of the ETF’s.

Palladium traded largely sideways over the month once the bottom was put in place at the US520 level late in August. Since then it has been range trading between US570 and US600 but it is starting to threaten the upside once again.

Most of this move back up seems to be from short position holders taking profits and some non-committal longs being established. The mood generally is fairly muted with response to the any decision by the FOMC seen to be unpredictable.

The ETFs have also seen some light liquidation which is assisting to cap any rally.

Fundamentally there is little to work with as there does not appear to be much changing in demand and supply sphere at this point so creating any direction from these drivers is difficult at the moment. The quietening of the Chinese stock markets, however, should inspire a little more confidence in the overall growth story for them and by association translate into a slightly rosier picture for world growth .

Written by Mike Ward. First appeared in Jewellery World Magazine September Edition 2015.