MINE TO MARKET - August 2014

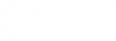

The ructions in the markets and the volatile trading conditions have continued into August unabated. Gold traded largely on the back of the relative strength (or weakness) of the USD and the movements in the long-term interest rates as an indicator of the propinquity of the Fed’s first interest rate hike in over 8 years. Russian/Ukraine hostilities and the continuing escalation of rhetoric and even some direct action from the US in Iraq, have also only had a short-term effect on the prices. So overall the market seems to be settling into a jittery range between USD1275 and USD1330.

USD Gold Chart July- Aug 2014

Source: Bloomberg

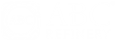

Silver has given back much of its speculative gains from late June and early July and the gold/silver ratio has settled back to a more usual mean level at around 65.50:1. Once heavy profit-taking set in (particularly in the US futures contracts) it could barely recover, even with gold making double-digit gains during a couple of New York sessions.

USD Silver Chart July- Aug 2014

Source: Bloomberg

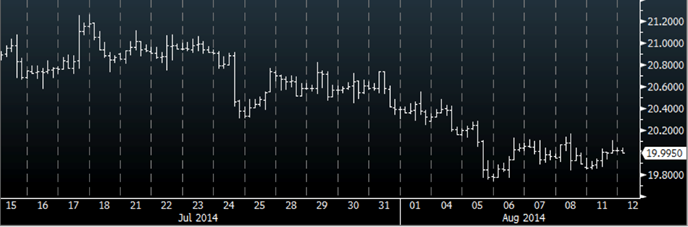

Platinum and even Palladium came under fire as well and the seemingly invincible position palladium held at the USD870-880 levels finally capitulated and it dropped to support at USD840 before showing signs of recovery. Again the futures positions in the US markets seem to be the main drivers here, rather than the interbank markets or the Exchange Traded Funds (ETF’s).Speculative positions seemingly flip-flop from long to short and back again on a whim. With the lack of volume that is always typical for this time of year in the northern hemisphere, the impact on price can be quite severe.

General talk about Calpers (the huge Californian pension fund) supposedly rethinking its long position in the commodities space, did nothing to inspire confidence in markets that were already struggling, in an environment that realistically should have seen them well bid and generally buoyant.

The pressure is on all of these markets to find support at current levels and the end result may be a consolidation within the currently defined ranges awaiting direction from further news or when the broader market players return in the latter part of September.

USD Platinum Chart July- Aug 2014

Source: Bloomberg

USD Palladium Chart July- Aug 2014

Source: Bloomberg

Written by Mike Ward. First appeared in Jewellery World Magazine August Edition 2014.

I created a more "vertical" version of a container garden, and this is what I used - http://bit.ly/1Bnj0aU