MINE TO MARKET - August 2015

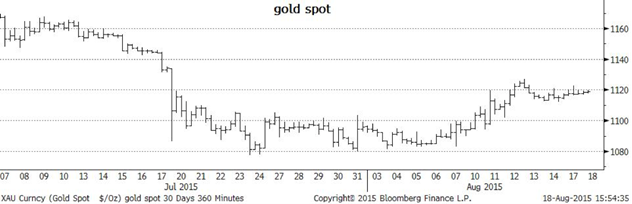

Gold

The much heralded breakdown of the US gold market finally occurred on Monday 20th July. Once the USD1130 area was decisively breached there was daylight until the USD1088 area was hit. At this point a vicious rally took gold back up above the USD1100 area until further selling and liquidation emerged. Probably the most unusual part of the whole move was that it occurred during the Asian session rather than the usual London or New York time zone. The post mortem revealed that the whole gyration was caused by the sale of around 5 tonnes in one lick into the Shanghai Gold Exchange. Although this may sound like a large amount of gold, in the overall scheme of the markets these days, it was probably more the way it was traded rather than the volume that caused the meltdown.

It is also a reflection of huge number of stop-loss orders that had been left in the market under this 1130 level that had no ability to get filled because of the lack of liquidity. This only exacerbated the move.

Many speculators believe that by leaving a stop-loss in the market, they are safe as they will be “stopped out” at the price at which they have left their order. In reality the stop loss level is merely a trigger for the platform looking after the order to try to find a price and get out. If there is no bid to hit, the machines will search until they do and then will sell on the first one they find. In the case of the 20th July this may have been some $30 or $40 below the level at which the stop-loss was left.

This is definitely a trap for young players and one that can savage all of the investment monies (plus some) as was seen in the case of the Euro meltdown in January after the Swiss walked away from the pegging to that currency. In this case some of the platforms ended up carrying the can for the difference between the amount of money in the customer’s account and the actual cost to exit the position. No such stories from the gold meltdown have been well publicised, but they no doubt have occurred.

As if this wasn’t enough, further ructions were caused by the Chinese announcing two large devaluations of the Renmimbi, two days in a row. The first one completely blindsided most traders and the US gold didn’t know where to go. Initially it sold off (presumably on the view that the Chinese would not have as much money to invest into it) and then it rallied again. At the same time the AUD sold off aggressively giving an overall effect of a price that was AUD30 higher at the end of the day than where it started it.

Since then, the US gold price has staged a recovery almost back to the USD1130 level where the whole shenanigans started. This classic form of “gap-filling” will satisfy the chartists that the move is complete and gold can once again decide where it wants to go from here.

It is now largely a toss of the coin, but the fact that all this has happened and the US interest rate hikes have still not even started, means there is probably some more volatility (and pain) to be endured before the speculators and physical traders work out who is going to win the next battle.

The question of who will win the whole war is still very much undecided.

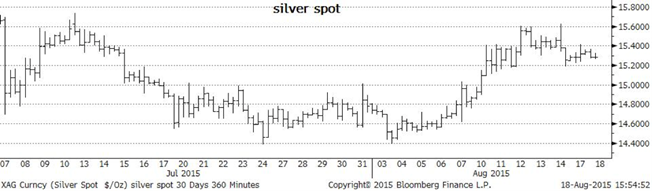

Silver

Silver has had the same roller-coaster ride as gold in the last couple of weeks although the implications for silver as an industrial metal as well as a speculative one, seem to be weighing more heavily on it as the Chinese implicate that their economy is not as strong as it has been (or as speculators had hoped) by devaluing their currency.

Hence, although it has rallied back above US15.00 after plumbing a low of US14.45, it appears further rallies from here may be a little more circumspect in nature.

Although net speculative length in the market has increased by some 37 million ounces in the last couple of weeks the ETF total positions have barely moved and the price has only managed to rally around 20 cents an ounce. This implies that the physical supply and sale of silver is continuing apace and that the physical buyers are looking for a price back under US15.00 to add to their stocks of the metal with the view that this is a bounce in price rather than a protracted rebound and rally.

Platinum and Palladium

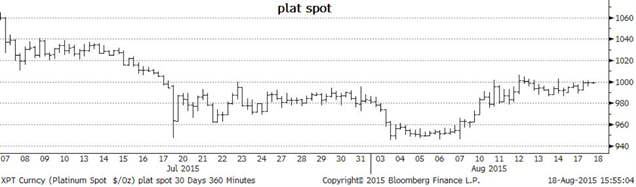

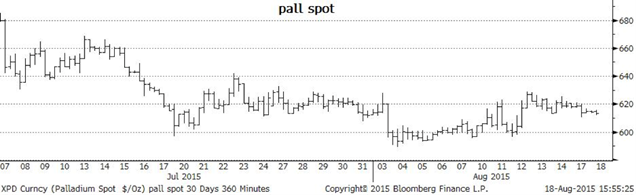

Platinum and palladium have benefitted from the rally in the other precious metals but again, as industrial metals, the implications of a slowing China seem to be holding them back from a full-blooded rally.

Platinum climbed briefly over the US1,000 level as gold rallied, but failed to hold onto it and is now situated just below that “magic” number. Even with short positions being stopped out as the price rose, increases in the net speculative long positioning and inflows into the ETF quickly petered out and the market is delicately poised to make its next move from here.

Palladium was also dragged along for the ride although it did lag the other metals. This is mostly a reflection of the commitment of the short position holders to stay with their view. It did finally run higher and managed a move over the US600 level up to a high of US628, but it has eased again and, like platinum, appears to be awaiting further news to decide its next direction.

Written by Mike Ward. First appeared in Jewellery World Magazine August Edition 2015.