MINE TO MARKET - May 2015

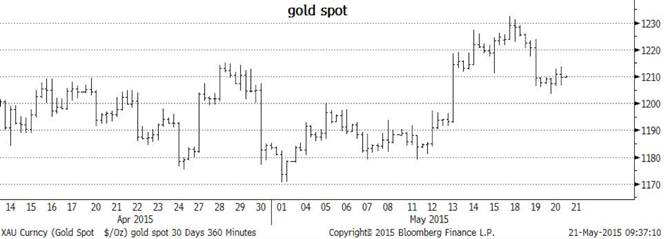

Gold

The metals markets generally continue to be fixated on the US economy, its interest rate scenario and the overall strength (or weakness of the US dollar against the basket of currencies. Gold has continued to be the key indicator of the market’s view on these economic factors. May saw some weak economic data coming out of the US causing a lowering of the long end US interest rates and a softening of the dollar. The result was another short covering rally pushing gold up through the 1220.00 level which was a key resistance point in the previous month’s run and on to US1230.00 before pausing for breath. The short-covering now appears to be complete and the question is whether punters are bullish enough to try to take gold back up to the levels seen earlier in the year of around US1300.00. The problem for gold from here is that it is now running into levels where there are a significant number of “stale” long positions which have been in the market for some time with little opportunity to take profit. It is also approaching very attractive levels in AUD terms (up around AUD1540.00) which previously has spurred some hedging from the Australian gold producers. To carry on from here gold probably needs a fresh driver outside of pure economic factors to drive it up through US1238.00 and on towards US1250 again. Geopolitical forces have been relatively quiet for the last two months so there may be some scope for action here. Showing just how skittish the market is, just one positive number out of the US (better than expected housing starts for April) managed to relatively easily push gold back USD20 per ounce.

Balanced on a knife’s edge is probably the best description for gold right now.

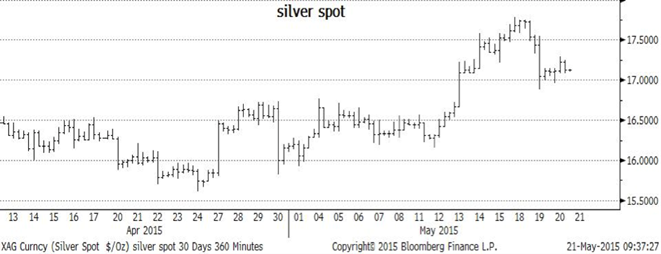

Silver

Silver went for a run along with the gold and outperformed it overall. Once it broke up through the US16.50 level it quickly hurdled 17.00 and ran on to a high just short of US18.00. The gold/silver ration which has not been under 1:70 all year broke down to 1:69 which, although historically is not an exceptional level, in light of the recent drubbing it has been taking, is a reasonable recovery. Silver, however, is going to suffer from the same condition that blights gold. There is still a huge outstanding long position (particularly in the ETFs) with a price range that has given speculators little opportunity to take profit. The temptation to take some value off the table is growing and at the same time silver producers are again looking at hedging in this volatile metal knowing from experience how savage the turnarounds can be.

The turnaround in gold has already pushed silver back down towards the US17.00 level and the pressure is now on for it to try to hold on to its hard won gains.

Platinum and Palladium

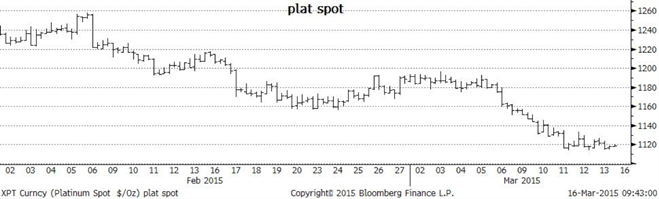

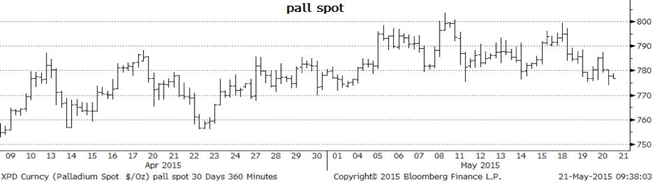

Platinum and Palladium both had a shot at their recent highs and platinum in particular skipped along in leaps and bounds. Both however struggled at their prime resistance levels, (platinum at US1180 and palladium at the US800 level. The increase in speculative interest from the classic platforms like TOCOM and NYMEX futures markets were fairly well offset by profit-taking leaking out of the ETFs and so net speculative positions are probably still at the same sort of overall levels seen in previous months, although the distribution across the market offerings is more diverse now.

In terms of overall drivers for the PGMs going forward, palladium is still a rosier picture than it is for platinum. The increased demand for petrol driven cars from China and North America has recovered well from the global crisis and the added requirement for palladium for catalytic converters on an already constricted market augurs well for breaking of the resistance level at US800 (assuming the growth of the industries in both nations continues on its current course).

For platinum, where a large part of its automotive demand depends upon the pick up in diesel vehicle demand in Europe, the outlook is not so positive. As the Eurozone continues to flounder through its economic woes, the demand for vehicles generally has been anaemic and certainly not running at the rate seen in the US and China. Platinum supply, also has improved with the resumption of mining in South Africa from mines that were strike-bound this time last year.

The result of all this will probably be a continued narrowing of the platinum/palladium ratio from the average of around 1:1.7 to the 1:1.5 or even 1:1.4 level.

Written by Mike Ward. First appeared in Jewellery World Magazine May Edition 2015.