MINE TO MARKET - June 2015

Gold

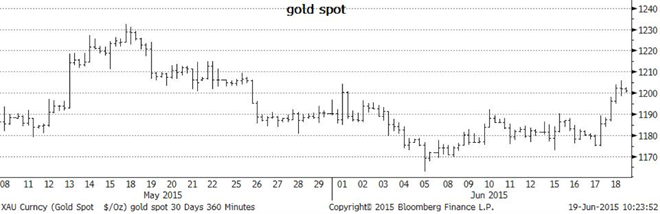

Again, over the last month, all eyes are on the U.S. and its halting recovery. It seems the markets are still struggling with the concept that the road to growth is never an easy (or linear) process. Mid May brought a raft of numbers that suggested that the U.S. was back on Struggle Street and a couple of underperforming economic numbers was all it took to predicate a sell-off in the US Dollar index and a fall in US bond yields. At the same time the precious metals (particularly gold and silver) saw panic short-covering and even some long positioning ready for a string of data that would confirm the US economy had “gone to water” again. Gold rallied to US1230.00/oz in quick time at which point the market awaited confirmation that this was a trend.

As has so regularly been the case, however, the numbers then started to show the US was not totally off the rails and a higher than expected employment number forced the nervous longs back out of the market. Gold plumbed depths close to US1160 /oz before staging a recovery, largely thanks to underlying physical demand from China and India.

This physical buying continues to become apparent each time gold dips below the US1180 level and currently seems to be enough to put a floor in place.

Everyone then waited for the dissertation from the Fed Open Markets Committee to shed some further light on the timing and size of expected interest rates hikes. Once again the consensus seems to be that the first one should be in September and another in December taking the Fed Funds rate to .625% from the current .125%. There were actually no real surprises in the statement and the gold and silver managed to rally off their lows but only back to oft-worn, middle-of-the-road levels of US1200 for gold and just above US16.00 for silver.

The Greek financial crisis is also playing its part in the precious metals markets but its impact is varied from metal-to-metal and even viewpoint-to-viewpoint.

Certainly, in recent history, any rallying effect from geo-political factors like this seem to quickly dissipate in the face of ongoing fundamental liquidation of positions set up specifically for this type of price action. The old adage of “buy the rumour, sell the fact” has, in hindsight, been sage advice for the gold market in these event-driven reactions.

Overall it does seem that the gold market is relatively non-committal at these levels and there appear to be no large overhanging positions on either side of the market that will get easily spooked unless an extraordinary event occurs. We are also heading into the “summer doldrums” for the Northern Hemisphere and many of the fund managers and macro traders are probably working harder on getting the best deal on a summer rental property for the next two months rather than trying to pick the gold market.

Silver

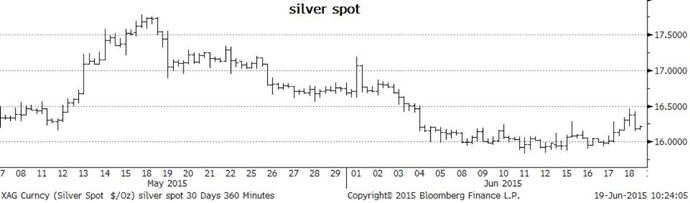

Silver reacted in the same way as gold to the available data but, as usual, did it with a lot more gusto. The price action on silver saw it whip-saw over 10% in the month and justifies its reputation for not being a speculative instrument for the faint-of-heart.

Positions finally leaked out of the stalwart ETF space as long-time holders finally took some value off the table as it neared USD17.75. Silver punters have definitely learned not to dilly-dally too long if they want to get in and out of this market with their skin and, as mentioned in previous reports, the turnarounds tend to be brutal and relentless with endless opportunities to chase the market down waiting for a rally that comes too late.

Silver is finding some good support below the USD16.00 level, however, and (for the time being at least), dips are being bought down at around the USD15.80 level.

After a very short, sharp rally after the FOMC statement it does seem to be settling back a bit and, like gold, if the support breaks, it may be a case of “look out below!”

Platinum and Palladium

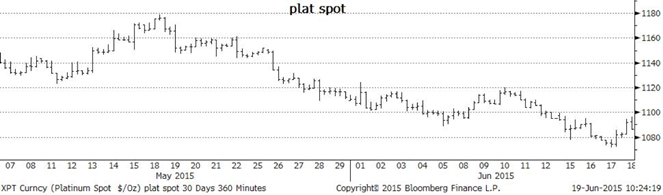

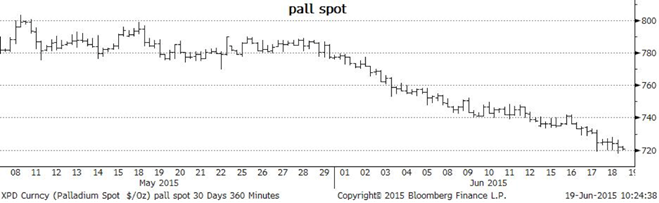

Platinum and Palladium both saw liquidation out of their ETFs over the month and, like the other precious metals, are battling to hold onto their lower bounds right now. Somewhat unusually, platinum is holding its ground a little better at these lower levels when compared to palladium which has now broken through its long-time support at US735.

Platinum’s performance is even more surprising when the Greek crisis and its flow-on to the Eurozone is taken into account. The potential for the European economies to recover strongly, while this X-factor hangs over their heads, is extremely limited. As a result and as has been mentioned previously, the demand for platinum for this largely diesel-powered vehicle environment, would also seem to be very restricted.

Platinum, however, has not suffered from such concerted speculative selling in the last month as palladium has had to endure. Speculative short positions in palladium on the CME futures market grew by almost 600,000 ozs in the last month. This is a huge number in view of the very limited production and overall availability of palladium. A failure to fall further from here, however, (or the first whiff of profit taking) will almost certainly spark a quick rally from these lower levels.

Written by Mike Ward. First appeared in Jewellery World Magazine June Edition 2015

June 2015 Commentary

Gold

Again, over the last month, all eyes are on the U.S. and its halting recovery. It seems the markets are still struggling with the concept that the road to growth is never an easy (or linear) process. Mid May brought a raft of numbers that suggested that the U.S. was back on Struggle Street and a couple of underperforming economic numbers was all it took to predicate a sell-off in the US Dollar index and a fall in US bond yields. At the same time the precious metals (particularly gold and silver) saw panic short-covering and even some long positioning ready for a string of data that would confirm the US economy had “gone to water” again. Gold rallied to US1230.00/oz in quick time at which point the market awaited confirmation that this was a trend.

As has so regularly been the case, however, the numbers then started to show the US was not totally off the rails and a higher than expected employment number forced the nervous longs back out of the market. Gold plumbed depths close to US1160 /oz before staging a recovery, largely thanks to underlying physical demand from China and India.

This physical buying continues to become apparent each time gold dips below the US1180 level and currently seems to be enough to put a floor in place.

Everyone then waited for the dissertation from the Fed Open Markets Committee to shed some further light on the timing and size of expected interest rates hikes. Once again the consensus seems to be that the first one should be in September and another in December taking the Fed Funds rate to .625% from the current .125%. There were actually no real surprises in the statement and the gold and silver managed to rally off their lows but only back to oft-worn, middle-of-the-road levels of US1200 for gold and just above US16.00 for silver.

The Greek financial crisis is also playing its part in the precious metals markets but its impact is varied from metal-to-metal and even viewpoint-to-viewpoint.

Certainly, in recent history, any rallying effect from geo-political factors like this seem to quickly dissipate in the face of ongoing fundamental liquidation of positions set up specifically for this type of price action. The old adage of “buy the rumour, sell the fact” has, in hindsight, been sage advice for the gold market in these event-driven reactions.

Overall it does seem that the gold market is relatively non-committal at these levels and there appear to be no large overhanging positions on either side of the market that will get easily spooked unless an extraordinary event occurs. We are also heading into the “summer doldrums” for the Northern Hemisphere and many of the fund managers and macro traders are probably working harder on getting the best deal on a summer rental property for the next two months rather than trying to pick the gold market.

Silver

Silver

Silver reacted in the same way as gold to the available data but, as usual, did it with a lot more gusto. The price action on silver saw it whip-saw over 10% in the month and justifies its reputation for not being a speculative instrument for the faint-of-heart.

Positions finally leaked out of the stalwart ETF space as long-time holders finally took some value off the table as it neared USD17.75. Silver punters have definitely learned not to dilly-dally too long if they want to get in and out of this market with their skin and, as mentioned in previous reports, the turnarounds tend to be brutal and relentless with endless opportunities to chase the market down waiting for a rally that comes too late.

Silver is finding some good support below the USD16.00 level, however, and (for the time being at least), dips are being bought down at around the USD15.80 level.

After a very short, sharp rally after the FOMC statement it does seem to be settling back a bit and, like gold, if the support breaks, it may be a case of “look out below!”.

Platinum and Palladium

Platinum and Palladium both saw liquidation out of their ETFs over the month and, like the other precious metals, are battling to hold onto their lower bounds right now. Somewhat unusually, platinum is holding its ground a little better at these lower levels when compared to palladium which has now broken through its long-time support at US735.

Platinum’s performance is even more surprising when the Greek crisis and its flow-on to the Eurozone is taken into account. The potential for the European economies to recover strongly, while this X-factor hangs over their heads, is extremely limited. As a result and as has been mentioned previously, the demand for platinum for this largely diesel-powered vehicle environment, would also seem to be very restricted.

Platinum, however, has not suffered from such concerted speculative selling in the last month as palladium has had to endure. Speculative short positions in palladium on the CME futures market grew by almost 600,000 ozs in the last month. This is a huge number in view of the very limited production and overall availability of palladium. A failure to fall further from here, however, (or the first whiff of profit taking) will almost certainly spark a quick rally from these lower levels.