MINE TO MARKET - February 2015

February 2015 -Monthly Commentary

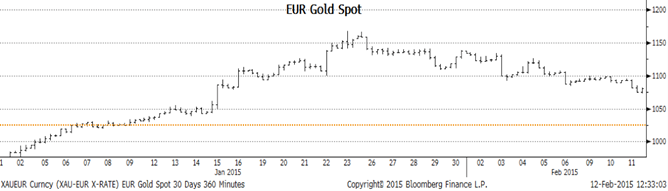

Gold started the year on a tear, rallying strongly with a generally weaker US dollar and a flight to quality as the Swiss National Bank removed the Swiss Franc’s peg to the Euro; leaving the latter in a freefall. The move was largely unexpected and the bloodbath that ensued left Euro holders licking their wounds and some trading platforms calling for financial support as speculators lost considerably more than the value in their accounts and the lack of liquidity in the market made exiting the currency trades impossible. As a result Euro denominated gold benefitted significantly and the buying pushed up the price in USD gold as well.

USD gold moved rapidly to USD1265 an ounce and then continued on its run as weaker US data spurred more interest from speculators on the grounds that the US interest rate hikes would be postponed somewhat. At the same time China seems to continue to suck up gold as fast as it can, with reports that 255 tonnes was taken out of the Shanghai Futures market over the month of January. Pundits are extrapolating this number over a 12 month period to create an argument that China is now taking all of the world’s gold supply on a yearly basis. More rational observers, however, are noting that this is the period before Chinese New Year which is recognised as the highest demand period for gold in China. It was also probably a sign of the number of long positions in the market that the gold rallied initially before falling USD40 in one session when numbers as simple as a better-than-expected Non-Farm Payrolls number in the US suggested the recovery there is still on track.

On the plus side for gold, there is talk that the Indian Prime Minister Narendra Modi is considering reducing the hefty 10% import duty on gold by up to 4%. This would probably cause a knee-jerk spike in gold but in reality much of the gold requirement for India has probably been sated by other “entrepreneurial” travellers. Word is that the level of gold smuggling has reached a high-water mark not seen for many years.

From a parochial viewpoint, the AUD denominated gold price reached a level early in February that rivalled its all-time high of AUD1735 an ounce and it peaked at AUD1684.00 before the AUD found its footing again and the AUD gold fell back to the AUD1625.00 level in quick time.

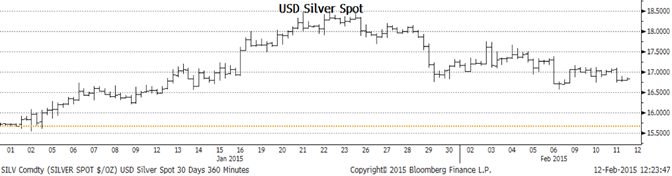

Silver definitely played second fiddle to gold last month and although it did tag along on gold’s rally, it didn’t outperform it in any significant manner. The gold/silver ratio still hangs on stubbornly at around 1:72 which means silver is still relatively cheap in comparison to gold on an historical basis. It appears that some of the long positon-holders in the futures market took the opportunity to lighten the load during the rally with around 25.5 million ounces of long positions being liquidated in the last week or so. The ETF holdings continue to grow, however, but at a much slower pace with only about half a million ounces being added to the total in the same time period.

It is difficult to draw a rosy picture for silver’s industrial demand side in light of the still anaemic global recovery. The continued recovery in the US and the implicit increase in demand from the investment and jewellery sectors is still providing the best hope for a pick-up in prices for silver in the next few months .

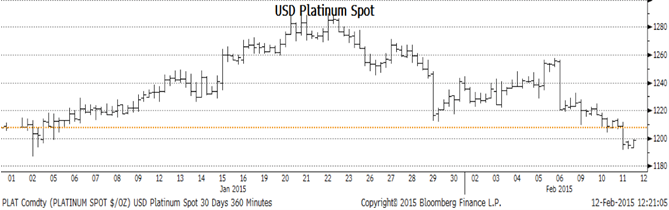

Source: Bloomberg

Platinum is struggling to hold the USD1200 level after having a stellar run up to highs of USD1285.00 early in January and then having another go at USD1260 in February, before falling in a heap. The description of the price action for platinum would have to make reference to the old adage of “taking the stairs up and the elevator down” as the liquidation from both rallies was rapid and relentless.

This is probably largely a reflection of the turmoil in Europe and the realisation that any hopes for the increase in volume from an uninterrupted supply chain this year being taken up by the European industrial sector, is fading fast.

Some liquidation out of one of the newly formed South African platinum ETFs did not help the metal’s cause either. The relatively quick turnaround by one of these funds changing from a driver of overall demand last year to becoming an additional source of supply this year, creates a double-whammy that is difficult for a relatively illiquid metal like platinum to absorb.

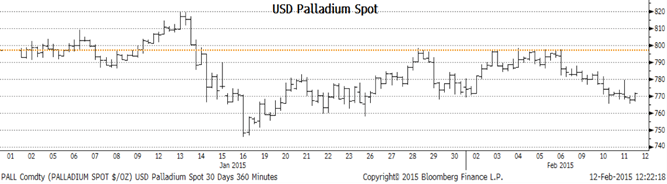

It looked for a while like palladium may shrug off the pessimism displayed by the other white metals and it had numerous concerted attempts to breach the USD800 level. Eventually, however, the weight of selling and profit-taking took its toll and the market capitulated. Again, hopes for a strong global recovery and increasing demand for motor vehicles withered in light of the patchy economic numbers coming out of the US. Like platinum, palladium is staring down the barrel of increased production this year and without a corresponding increase in demand it will also face an uphill battle on the price front.

Some of the speculative positioning has been reduced in palladium, however, with the net longs on the NYMEX market falling by around 47,000 ounces and the ETF holdings falling for the last 5 weeks. These reductions will hopefully lessen the selling pressure on any rally from here.

Realistically palladium is looking like a range trade between the US750 to US800 level for the next little while until something breaks it out of its torpor.

Written by Mike Ward. First appeared in Jewellery World Magazine February Edition 2015.