MINE TO MARKET - April 2015

Gold

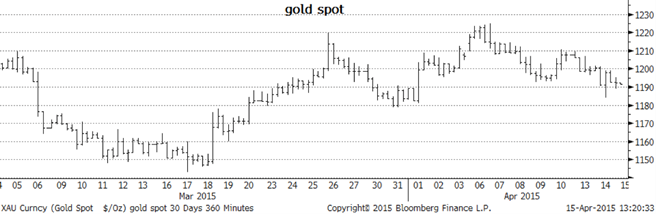

As predicted in last month’s commentary, gold did stage a rally from the mid USD1150 area and managed to get as high as USD1225.00 before running out of steam as short-covering subsided and the bargain-hunting from lower levels ceased. Unsurprisingly, the main catalyst was again the spotty numbers coming out of the US regarding its economic performance and the on-again, off-again timing for the first US interest hike. Is it going to be June or is it going to be September (or even December as some are now starting to suggest)?

The gold market as a result continues to flummox around as it tries to react to seemingly every piece of data coming out of the US, Euroland and China. The resulting volatility makes it a market not for the faint-hearted with USD10 swings being seen as almost the norm for any trading session. In Euro, Sterling and AUD terms the market is even more volatile with AUD gold moving through ranges of up to AUD30 on a day with the AUD bouncing around on every number that appears as well. This is really not sustainable price action and will settle down into a range but the big question is what that range will be.

In the USD gold market there appears to be good resistance up towards USD1220 and it is finding support in the low 1190’s . Realistically, the resignation to the fact that interest rates are going to rise in the US is probably the most important overall driver of the gold price and is pretty much priced in now. The speed and extent of further rate hikes is actually going to be more important going forward and will quickly become the focus once the first hike has occurred.

There is no doubt that hedge funds and other traders are using the low interest rate environment in the US to borrow dollars and invest into a whole range of products (including commodities like gold, silver, PGMs and base metals). Significant rate hikes will not only make cash more expensive but also put pressure on the products invested in, to perform better and generate returns which justify the investment in them.

Gold could well suffer as a result of this paradigm shift putting further pressure on US producers who are already struggling with skinny margins and little or no hedging to protect them in a time of falling prices.

The saviour for gold denominated in other currencies is that their devaluation in the face of an improving US dollar, will cushion the blow somewhat and the price drops in EUR, Sterling and AUD denominated gold will probably not be as large as it could be for US gold.

Already we are seeing this sort of impact occurring. The relatively small rise in US gold in recent times, combined with a sell-off in EUR and GBP has moved Euro gold up 3.50% and Sterling gold up over 2.00% in the last couple of weeks.

The main risks to this scenario which could create a further rally in USD gold are a serious geopolitical crisis (although we have seen a couple of these already and the effects have only been short-lived) or the US economy completely falling off the rails again.

Silver

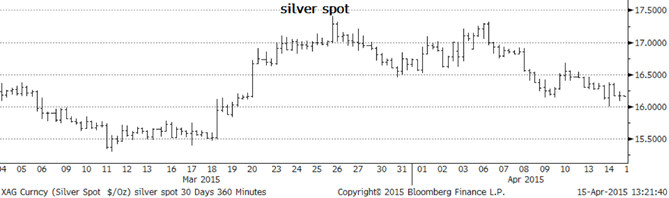

Silver made a couple of valiant attempts to rally over the month and even outperformed gold on a couple of occasions but in the end succumbed to the unerring selling pressure which seems to be so much a part of the silver market currently.

Probably its greatest inherent problem is the fact that a large proportion of the silver production worldwide comes about as a by-product of gold or base metal production. So, from a producer’s perspective, they can build up stocks of silver in their metal accounts and sell it opportunistically when the price rises. This problem is exacerbated now by the influence of pure silver producers, who are happy to sell and lock in forward prices at levels that guarantee margins. They are not dogged by the shareholder and investor pressure that gold miners face, where the argument is often put that they should not hedge at all but leave the “blue sky” upside so the shares will outperform in a bullish gold environment. Unfortunately this often runs contra to a pragmatic approach to company stewardship that would dictate that selling some production forward, at a price above the cost of production, is prudent management of a mining business.

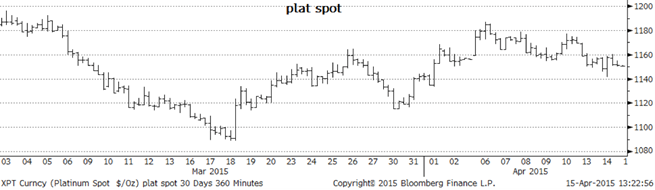

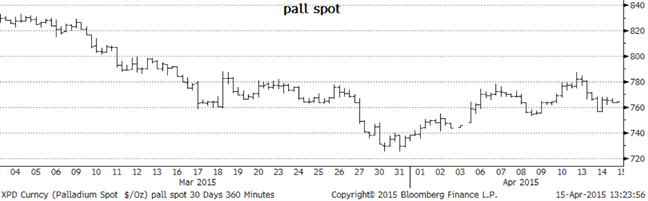

Platinum and Palladium

Platinum and Palladium are largely just range trading in the current market with much of the speculative ETF demand satisfied and the fundamental supply/demand balance becoming a material driver of the prices again. The recognition of the liquidity issues for both of these metals has probably quelled much of the speculative fervour for the PGM’s as traders recognise that positions (and particularly large positions) are difficult to manage in markets that do not have the fundamental depth in their underlying trading volumes and have only a small number of physical producers and end-users relative to the large deep markets like gold.

Having said that, net long speculative positioning on NYMEX in platinum and palladium did grow over the period but this appears to be largely short covering rather than new long positions being established.

Platinum appears stuck in a USD1115 to 1185 range with palladium running around between USD745 to 785 currently.

Written by Mike Ward. First appeared in Jewellery World Magazine April Edition 2015.